Dear friend,

Here is your weekly dose of financial wisdom.

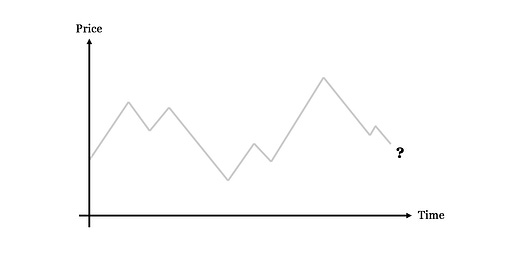

Tips for Random Walkers

In A Random Walk Down Wall Street, Burton Malkiel provides some tips on achieving financial prosperity while believing that stock prices are unpredictable.

Understand your investment objectives. Distinguish between your attitude toward and your capacity for risk.

Consistently save a portion of your income. The most important driver in the growth of your assets is how much you save.

Keep some reserves in safe and liquid investments. Remember Murphy's Law: what can go wrong will go wrong.

The core of every portfolio should consist of low-cost, tax-efficient, broad-based exchange-traded funds (ETFs).

Control the things you can control: investment costs and taxes. You can’t do anything about the ups and downs of the market.

Diversify. It reduces risk and makes it far more likely that you will achieve the kind of good average long-run return that meets your investment objective.

The Noise Bottleneck

The problem with information is not that it’s generally useless, but that it’s toxic. Many don’t realize that media companies are paid to get their attention…

People often think that it will surely be the next batch of news that will really make a difference to their understanding of things.

"The wise man listens to meaning; the fool only gets the noise" — C. P. Cavafy

The Lindy Effect is a useful heuristic (coined by Nassim Taleb) you can use to separate noise (news, clickbait media) from signal (research, books, and principles that have stood the test of time). It postulates that the the older a non-perishable thing is, the longer it's likely to be around in the future.

That is why Babylonian wealth principles are more robust than modern financial theories. For an idea to have survived so long across so many cycles is indicative of its relative fitness.

5 Laws of Gold

In The Richest Man in Babylon, George S. Clason lays out five time-tested wealth principles (gold being the medium of exchange 4,000 years ago).

Gold comes in increasing quantity to the person who saves at least 10% of their earnings to create an estate for his future and that of his family.

Gold labors diligently and multiplies for the person who finds for it profitable employment.

Gold clings to the protection of the person who invests their gold with wise people.

It slips away from the person who invests it in businesses or purposes with which they are not familiar.

It flees the person who tries to force it into impossible earnings or who follows the alluring advice of schemers.

To old principles,